How to Effectively Put Money in Your Investments

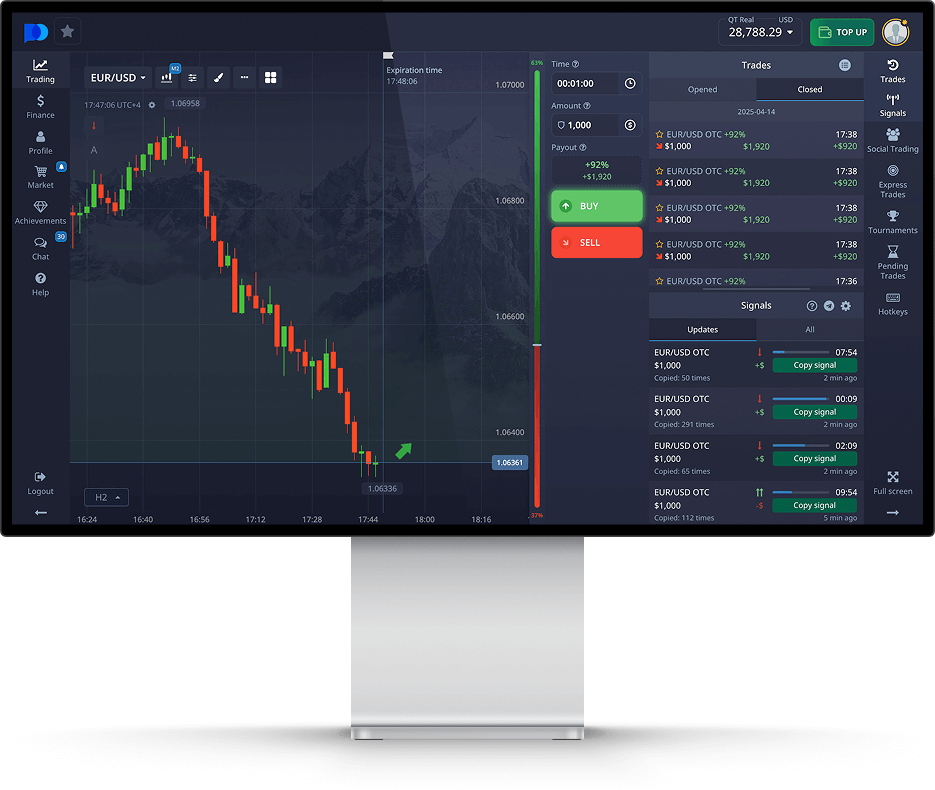

If you are looking to grow your wealth, understanding how to put money in various investment vehicles is essential. In this article, we will explore the different methods of investing money and the considerations you should make when choosing the right investment strategy. If you’re interested in online trading, how to put money in pocket option pocketoption-forex.com can be a great starting point.

Understanding Your Financial Goals

Before putting any money into an investment, it is crucial to establish clear financial goals. Are you saving for retirement, a house, or your child’s education? Understanding your objectives will guide you in deciding how much money to invest and where to put it. Having specific, measurable, achievable, relevant, and time-bound (SMART) goals will help you formulate a more effective investment plan.

Diverse Investment Options

There are numerous ways to put your money to work. Here are some popular options:

1. Stock Market

Investing in stocks can provide high returns but also comes with substantial risk. Before buying stocks, research the companies thoroughly and consider diversifying your portfolio across multiple sectors to mitigate risk.

2. Bonds

Bonds are typically considered safer investments compared to stocks. When you purchase a bond, you are lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity. They are a great way to balance a portfolio and provide steady income.

3. Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) allow you to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers, making them a great option for beginners who might not have the time or expertise to manage investments on their own.

4. Real Estate

Real estate can be a lucrative investment opportunity but requires significant capital and management skills. Investing in rental properties can provide a steady income stream, while buying properties to sell them at a profit can yield significant returns as well.

5. Cryptocurrency

Digital currencies, such as Bitcoin and Ethereum, have gained popularity as investments. However, enter this space with caution due to its volatility and complexity. A well-researched approach can lead to substantial gains, but the risks are equally high.

Choosing the Right Investment Account

When deciding how to put money into investments, you also need to select the right type of account. Here are some common accounts:

1. Brokerage Account

A standard brokerage account allows you to buy and sell a variety of investment products. This account usually comes with fewer restrictions, but gains are subject to capital gains tax.

2. Retirement Accounts

Retirement accounts, like IRAs or 401(k)s, offer tax advantages. Contributions might be tax-deductible or grow tax-deferred, making these accounts ideal for long-term investing and saving for retirement.

3. High-Interest Savings Accounts

While not a traditional investment option, a high-interest savings account can provide a safe haven for your cash while still earning some interest. This is a suitable option for your emergency fund.

Developing a Solid Investment Strategy

Having a strategy is key to successful investing. Here are some strategies to consider:

1. Dollar-Cost Averaging

This involves regularly investing a fixed amount of money, regardless of the investment’s price. Over time, this strategy can lower your average cost per share and mitigate the impact of market volatility.

2. Buy and Hold

This long-term strategy entails purchasing investments and holding onto them regardless of market fluctuations. It is predicated on the belief that investments will appreciate in value over time.

3. Value Investing

Value investors seek undervalued stocks that they believe will eventually provide a return. This strategy requires research and patience as it might take time for the market to recognize and correct the undervaluation.

4. Growth Investing

Growth investors focus on companies they believe will grow at an above-average rate compared to other companies in the market. This often involves investing in technology or innovative sectors.

Monitoring Your Investments

Once you’ve put your money into investments, monitoring their performance is essential. Regularly review your investments to see if they align with your financial goals. Adjust your strategy as needed, whether that means reallocating funds, selling underperforming assets, or reinvesting dividends.

Conclusion

Putting money into investments is an essential part of building wealth. By establishing clear goals and understanding your options, you can develop a strategy that works for you. Remember that investing is a long-term game; it’s crucial to stay informed and patient. Whether you’re considering stocks, bonds, or real estate, take the time to research and make decisions that align with your financial aspirations and risk tolerance. With the right approach, your investments can significantly contribute to your financial future.