Revolutionizing Forex Trading: Your Ultimate Guide to Success

Forex trading has become one of the most popular ways to invest and earn money online. With billions traded daily in currencies, many individuals are turning to forex as a viable option for building wealth and achieving financial independence. In this article, we delve into the essentials of forex trading, providing you with the knowledge necessary to navigate this dynamic market effectively. Learn the key strategies, tips, and even discover platforms that can enhance your trading experience, such as forex trading website https://kuwait-tradingplatform.com/.

Understanding Forex Trading

Forex, or foreign exchange, is the global market for buying and selling currencies. Unlike stock markets, the forex market operates 24 hours a day, five days a week, providing traders with the flexibility to trade whenever it suits them. The forex market is decentralized, meaning that it does not have a physical location or central exchange. Instead, currency trading is conducted over-the-counter (OTC) through a network of banks, brokers, and financial institutions.

The Mechanics of Forex Trading

In forex trading, currencies are traded in pairs, such as EUR/USD or USD/JPY. When trading a currency pair, you are essentially betting on the value of one currency in relation to another. For instance, if you believe that the Euro will strengthen against the US Dollar, you would buy the EUR/USD pair. Conversely, if you think the Euro will weaken, you would sell the pair. Understanding these fundamental concepts is essential for any aspiring forex trader.

Key Terms Every Trader Should Know

Before diving into forex trading, it’s crucial to familiarize yourself with some basic terminology:

- Pip: The smallest price move in the forex market, typically the fourth decimal place in a currency pair.

- Leverage: Allowing traders to control a larger position than their capital would normally permit.

- Spread: The difference between the buying and selling price of a currency pair.

- Lot: A standardized quantity of currency units traded on the forex market.

Building a Successful Trading Strategy

Successful forex trading requires a solid strategy. Here are some elements to consider when developing your trading plan:

1. Define Your Goals

Determine what you want to achieve with forex trading. Are you looking to make quick profits or are you interested in long-term wealth accumulation? Having clear goals will help you shape your strategy.

2. Analyze the Market

There are two primary types of analysis used in forex trading: fundamental analysis and technical analysis. Fundamental analysis involves evaluating a country’s economic indicators, policies, and news events. On the other hand, technical analysis focuses on historical price movements and chart patterns. A combination of both can provide a well-rounded view of the market.

3. Manage Your Risk

Risk management is essential in forex trading. Never risk more than you can afford to lose on any single trade. Setting stop-loss orders can help you limit potential losses, ensuring that you remain in the game for the long haul.

4. Stay Informed

The forex market can be heavily influenced by global events, economic releases, and geopolitical tensions. Stay updated with the latest news and analysis to understand market trends and potential volatility.

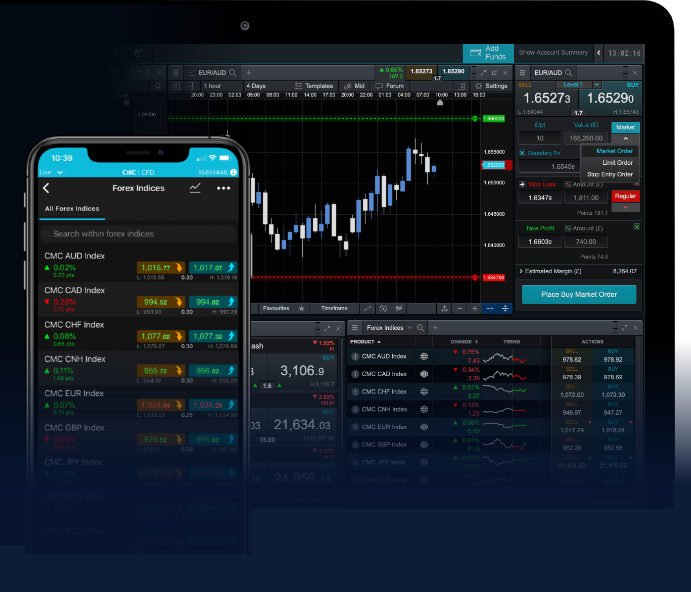

The Role of Trading Platforms

The choice of trading platform can significantly impact your trading experience. Many platforms offer user-friendly interfaces, advanced charting tools, and educational resources. When selecting a platform, consider factors such as:

- Ease of use

- Available currency pairs

- Trading tools and resources

- Customer support

- Fees and commissions

Psychology of Trading

Forex trading is not only about strategy and analysis; it’s also about the psychology of trading. Emotions such as fear and greed can negatively impact your decision-making process. Developing a disciplined mindset and sticking to your trading plan is essential for long-term success. Consider implementing techniques such as mindfulness and maintaining a trading journal to track your progress and emotions.

Community and Resources

Joining a trading community can provide valuable insights and support. Online forums, social media groups, and mentorship programs can connect you with other traders, enabling sharing of strategies and experiences. Additionally, investing time in educational resources like books, webinars, and courses can further deepen your understanding of forex trading.

Conclusion

Forex trading offers vast opportunities for those willing to learn and adapt. Understanding the fundamentals, developing a solid trading strategy, and managing your emotions are key to succeeding in this competitive market. With the right tools, knowledge, and support, you can embark on a successful forex trading journey. Remember that every trader starts as a beginner, and with determination and practice, you can master this exciting domain of finance.

For more information and valuable resources, explore reputable trading platforms that suit your needs, and always keep learning about the latest trends and strategies in forex trading.